GRAPHENE : Impact on Stock Market

Graphene, as a material, has the potential to revolutionize various industries due to its exceptional properties. However, it’s important to note that the impact of graphene on stocks is influenced by a multitude of factors, including technological developments, market demand, regulatory policies, and competitive dynamics.

Here are some ways in which graphene could potentially affect stocks:

-

Industry-Specific Stocks: Companies directly involved in graphene production, research, or applications could see fluctuations in their stock prices based on developments in graphene technology. This includes companies in materials science, electronics, energy storage, and other sectors where graphene has potential applications.

-

Research and Development (R&D) Investments: Companies investing heavily in graphene research and development may experience volatility in their stock prices. Positive breakthroughs or successful applications could lead to increased investor confidence and potentially drive stock prices higher.

-

Patent Holdings: Companies holding significant patents related to graphene production methods, applications, or specific technologies may experience fluctuations in their stock prices. Strong intellectual property portfolios can confer a competitive advantage and impact stock performance.

-

Supply Chain Impact: Graphene’s potential to disrupt traditional supply chains in various industries (e.g., electronics, aerospace, automotive) could affect the stock prices of companies within those supply chains. Companies able to adapt and integrate graphene into their products may experience positive stock performance.

-

Market Sentiment and Hype: Speculative interest and hype surrounding graphene could lead to short-term fluctuations in the stock prices of companies associated with graphene. This can be driven by media coverage, investor sentiment, and market speculation.

-

Regulatory Environment: Changes in regulatory policies or government initiatives related to graphene production, use, or safety could impact the stock prices of companies operating in the graphene sector. Positive regulatory developments could boost investor confidence.

-

Competitive Landscape: The emergence of new graphene-related technologies or breakthroughs by competitors could influence the stock prices of companies in the graphene space. Companies that maintain a competitive edge in graphene technology may see positive effects on their stock prices.

-

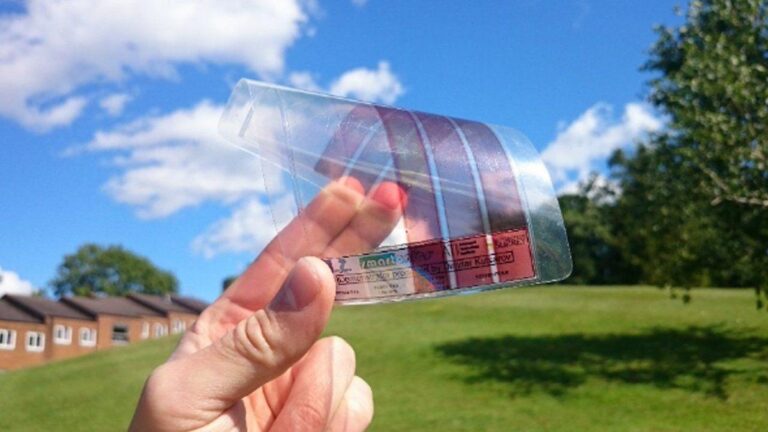

Market Adoption and Commercialization: The pace at which graphene technologies are adopted by industries and integrated into commercial products can significantly impact the stock prices of companies involved in graphene production and applications.

It’s important to emphasize that the graphene industry is still in its early stages, and widespread commercialization is ongoing. As such, potential impacts on stocks are speculative and subject to change as the technology matures and markets evolve. Investors should exercise caution and conduct thorough research before making investment decisions related to graphene or graphene-related stocks.